Encompassing every aspect of your financial life, our wealth management and financial planning services deliver customised strategies designed to meet your individual goals. From focused support to comprehensive portfolio management, our expert team applies deep insight and innovative thinking to guide you towards enduring financial success

Wealth Management Services

Who We Work With

TIME-POOR

BUSINESS OWNERS

Empowering your personal and business growth with strategic financial oversight

EXECUTIVES

Designing wealth solutions that leverage tax-effective opportunities

PRE & POST RETIREES

Securing your lifestyle and legacy for the long term

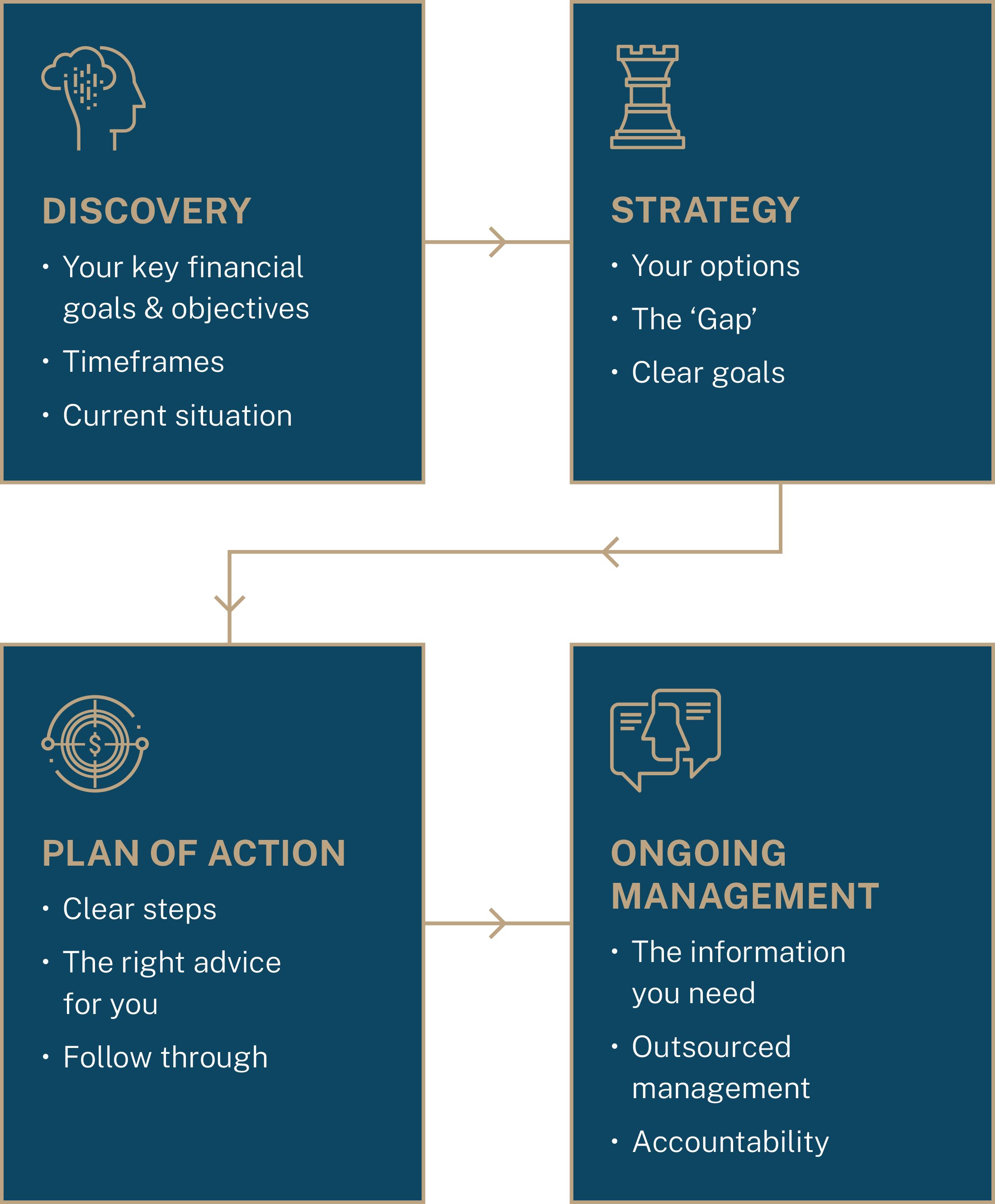

The Wealth Management Journey: One + Two = Three

Starting point

Our clients often come to see us as they are:

- Unclear about their options

- Keen to explore wealth creation possibilities

- Wanting leadership & expert direction

- Seeking greater certainty

- Concerned about risk

- Paying excess tax

- Keen to invest

- Disorganised and time-poor

- Beginning to consider

retirement

Ongoing Management

To grow your wealth over the long-term, Private Capital Management supports you through:

Managing the financial strategies that make up your financial plan

Direct access to your adviser and our team via phone, virtual & face-to-face

Annual Strategy review and refresh session with your financial adviser

Complete administration support for all financial matters from reporting to claims

Access to additional financial advice as needed, usually at no additional cost

Collaboration with your other professional advisers, such as your accountant

On-line access to all your wealth information

Up-to-date financial education and information via our client communication programs and seminar series

Financial Success

The result of our advice can include:

- Clear goals that are implemented and managed

- Right structure

- On-track through thick and thin

- Informed

- Reduced tax

- Family and interests protected

- Reduced risk

- Plan for retirement

- Investment strategy in place

How We Help Our Clients

DEBT MANAGEMENT

Our debt management services are designed to help clients set clear financial goals, create effective budgets, optimise offset accounts, and make informed decisions about managing or reducing debt. We focus on minimising interest costs and leveraging debt in a tax-efficient way to enhance long-term financial outcomes.

As a licensed Credit Representative, Private Capital Management offers expert mortgage broking services with a deep understanding of leveraged strategies. This unique blend of wealth management and mortgage expertise sets us apart from traditional mortgage brokers, delivering smarter, more comprehensive solutions for our clients.

ESTATE PLANNING

Estate planning is essential to protect your wealth and ensure your wishes are honoured. Key tools in estate planning include Wills, Powers of Attorney, Testamentary Trusts, and nominating beneficiaries for superannuation. These elements work together to provide clarity and security for your loved ones.

We collaborate with a network of trusted solicitors to prepare all necessary legal documents. For our full-service clients, we go a step further: joining you in the introductory meeting to ensure our financial recommendations align seamlessly with your estate plan. This personalised approach ensures your legacy is managed efficiently and according to your goals.

BUSINESS STRATEGIC ADVICE

Our business financial advice helps entrepreneurs maximise their assets, optimise borrowings, and safeguard their operations with business insurance. We work closely with business owners to develop strategies that enhance profitability, manage risks, and ensure sustainable growth.

Whether you’re looking to expand, restructure, or protect your business, our tailored financial solutions provide the tools and insights needed to achieve long-term success and financial security.

INSURANCE AND RISK PROTECTION

Personal insurance protects your lifestyle and financial well-being by limiting the impact of unexpected events or loss of life. Our comprehensive insurance solutions include Life Insurance, Total and Permanent Disability (TPD) Insurance, Trauma or Crisis Cover, Income Protection, and Business Insurance.

These policies are designed to provide financial support during challenging times, ensuring you and your loved ones can maintain your lifestyle and meet obligations, even in the face of adversity. We help you select the right coverage to suit your needs, offering peace of mind for the future.

WEALTH CREATION

Wealth creation is at the core of many client interactions, achieved through increased savings, smarter investments, and actively managing assets with a sophisticated approach. Our goal is to help you build wealth strategically by aligning your financial decisions with your long-term objectives.

In our discovery sessions, we take the time to understand your goals, preferred investment tools, and risk tolerance. While higher risk can lead to greater potential returns, it also carries the possibility of losses. Together, we’ll determine the right balance to suit your comfort level and financial aspirations.

We provide expertise on a broad range of investment products, including Cash, Bonds, Shares, Exchange Traded Funds (ETFs), Managed Funds, Alternatives, and Superannuation. Our tailored strategies are designed to empower you to grow your wealth with confidence

RETIREMENT PLANNING

Retirement planning focuses on two key stages: accumulating wealth to fund your retirement and maximising income during your pension phase when you begin drawing down on those savings. Our goal is to ensure you have the financial resources needed to enjoy a comfortable retirement.

To increase your retirement income, we help you grow your asset base through strategies such as making additional super contributions, investing in property, or leveraging debt to build a share portfolio.

We also specialise in optimising retirement income by maximising government benefits and efficiently managing your super and other assets. With tailored strategies, we ensure your wealth works harder for you throughout retirement.

TAXATION PLANNING

Our tax planning services aim to structure your finances in a tax-efficient and compliant way, helping you make the most of available opportunities within the legal framework. We focus on minimising tax liabilities while enhancing your overall financial position.

Strategies may include salary sacrifice arrangements, borrowing to invest, and negative gearing on investment properties or share portfolios. Additionally, we may recommend obtaining a depreciation report for investment properties to maximise tax deductions and improve cash flow.

By optimising your financial structure, we ensure your wealth grows efficiently, empowering you to achieve your long-term goals with confidence.

Frequently Asked Questions

CASH MANAGEMENT ACCOUNTS

A Cash Management Account (CMA) serves as a centralised financial hub for managing investment-related cash flows. Beyond simply holding cash, CMAs streamline tracking, management, and growth by integrating with other investment accounts. With competitive interest rates, minimal fees, and seamless access to funds, they provide an efficient way to maintain and grow wealth.

Key Benefits of Cash Management Accounts

- Centralised Financial Hub: CMAs consolidate all investment-related finances in one account, simplifying tracking and management.

- Competitive Interest Rates: Many CMAs offer interest rates that rival or surpass traditional savings accounts, helping your funds grow faster.

- Flexible Transactions: CMAs allow unlimited withdrawals and deposits, providing easy and quick access to your money whenever needed.

- Low or No Fees: Many cash management accounts feature low or no account maintenance fees, making them cost-effective for investors.

- Integration with Investment Accounts: Link a CMA to your share trading account or SMSF, streamlining portfolio funding and dividend distributions.

- Dividend Management: CMAs offer a dedicated place to receive and manage dividend payments, keeping your investment income organised.

- Financial Protection: Funds held in CMAs offered by authorised deposit-taking institutions (ADIs) are protected by the Financial Claims Scheme, covering deposits up to $250,000.

Who Should Use Cash Management Accounts?

CMAs are ideal for investors who want to keep their investment capital separate from everyday banking or savings. They are especially useful for:

- Self-Managed Super Fund (SMSF) Trustees: Securely manage retirement savings while separating them from personal accounts.

- Share Trading Account Holders: Keeping dividends and investment capital separate from personal funds.

- Property Investors: Managing rental income separately from personal finances.

- Business Owners and Professionals: Use CMAs to manage multiple income streams efficiently while maintaining liquidity for new investments.

How Private Capital Management Can Help

Private Capital Management can assist clients in optimising their CMAs by providing expert advice on selecting the best accounts, managing cash flows, and integrating CMAs with broader investment portfolios. They also help with strategic portfolio funding, ensuring dividend income is efficiently reinvested, and monitoring account performance for optimal returns. With their deep knowledge of SMSFs, share trading, and property investment, Private Capital Management ensures CMAs align with your financial goals and risk tolerance, offering peace of mind and financial clarity.

Through their holistic financial strategies, Private Capital Management helps investors leverage CMAs to enhance liquidity management while maintaining long-term financial stability and growth. Whether you’re managing super, dividends, or property income, Private Capital Management ensures seamless financial planning and wealth management every step of the way.

TERM DEPOSITS

A term deposit is a popular savings account in Australia that allows individuals to invest a fixed amount of money for a set period, offering a guaranteed interest rate throughout the term. It’s an ideal solution for those who want to save for a big purchase or secure a reliable return on their investment without worrying about market fluctuations.

Key Benefits of Term Deposits:

- Fixed Interest Rate: Term deposits provide certainty with a guaranteed interest rate, regardless of changes in market conditions, helping you reach your financial goals with predictable growth.

- Low Risk: As a secure investment option, term deposits protect your savings from market volatility, making them a safe choice for conservative investors.

- Locked-in Savings: Your funds are locked away for the chosen term (ranging from 1 month to 5 years), helping resist the temptation to withdraw and spend money impulsively.

- No Fees: Typically, term deposits come with low or no fees, and they often offer higher interest rates than regular savings accounts.

Things to Consider:

- Interest Rates and Inflation: While term deposits offer a fixed rate, they may not keep up with inflation over time, potentially reducing your money’s purchasing power.

- Early Withdrawal Penalties: Withdrawing funds before the term ends often incurs penalties, including reduced interest rates and administration fees.

- Interest Payment Frequency: Interest may be paid monthly, quarterly, annually, or at maturity. More frequent payments usually result in a slightly lower interest rate.

- Term Length: Longer-term deposits typically offer higher interest rates, but you won’t be able to take advantage of any interest rate increases during the locked-in period.

Ideal Uses for Term Deposits:

- Saving for Large Purchases: Perfect for saving for major expenses like a car or a home down payment.

- Certainty in Returns: A great option for investors who want guaranteed returns without the risk of market volatility.

When considering a term deposit, look for competitive interest rates and be mindful of early withdrawal conditions to ensure it aligns with your financial goals. Term deposits provide peace of mind with predictable, steady growth and are a valuable component of a low-risk investment strategy.

Bonds & Fixed Income

Bonds and fixed income investments are financial strategies where an investor lends money to a government or company in exchange for regular interest payments and the return of the original investment at maturity. These investments are ideal for those seeking a reliable income stream with lower risk compared to equities.

Types of Fixed Income Investments:

- Bonds: A type of fixed income investment where the investor loans money to a company or government, receiving fixed interest payments (coupon payments) over time and the return of the principal at maturity. Bonds can be sold before maturity, but are often held for their steady income.

- Australian Government Bonds (AGBs): Traded on the ASX, these bonds represent sovereign debt and offer guaranteed returns if held until maturity.

- Corporate Bonds: Issued by companies, corporate bonds provide funding for business activities and are traded in large denominations.

- Semi-Government Bonds (Semis): Issued by Australian states and territories, these bonds are another form of sovereign debt.

- Hybrid Securities: A mix of fixed income and equity characteristics, offering both interest payments and potential equity participation.

Benefits of Bonds and Fixed Income:

- Steady Income Stream: Bonds offer regular coupon payments, making them a reliable source of income.

- Capital Preservation: Fixed income investments help preserve capital and are generally less volatile than equities.

- Diversification: Bonds often perform in the opposite direction to stocks, providing diversification benefits within an investment portfolio.

- Lower Risk: Compared to equities, bonds are considered a defensive asset with lower risk, especially for conservative investors.

Key Considerations:

- Interest Rate Risk: Bond prices are inversely related to interest rates. When interest rates rise, bond prices typically fall, and vice versa.

- Credit Risk: There’s a risk that the bond issuer could default, meaning the investor may not receive coupon payments or the return of the principal.

- Duration: Duration measures a bond’s price sensitivity to interest rate changes. Bonds with longer durations are more volatile in response to interest rate fluctuations.

Types of Bonds:

- Fixed-Rate Bonds: Provide a consistent interest rate throughout the bond’s term, offering a stable income stream.

- Floating-Rate Bonds: Interest rates adjust based on a reference rate, such as the cash rate plus a margin, protecting returns if interest rates rise.

- Indexed Bonds: Payments are indexed against inflation (CPI), providing protection against rising inflation.

How Bonds Earn Money:

Bonds generate income through coupon payments and can also provide capital gains if sold before maturity, depending on market conditions. The yield on a bond is a measure of return, which fluctuates with the bond’s price and the prevailing interest rate environment.

Risks and Returns:

While bonds are lower risk than equities, they are still subject to market forces, including interest rate movements and credit risk. If a bond is sold before maturity, its market value may differ from the face value, affecting overall returns.

Conclusion:

For investors seeking low-risk, predictable returns, bonds and fixed income investments offer a stable and reliable income stream. With various types of bonds available, including government and corporate bonds, they provide a way to diversify portfolios and preserve capital while managing risk effectively. Always consider factors like risk tolerance, investment horizon, and interest rate fluctuations when choosing the right fixed income investment for your portfolio.

What are Shares

Shares, also known as stocks, equities, or securities, represent ownership in a company. When you purchase shares, you become a shareholder, giving you part ownership of the business and a potential share in its profits. In Australia, shares are traded on the Australian Securities Exchange (ASX), home to over 2,000 listed companies, including well-known names like Commonwealth Bank, Rio Tinto, and Woolworths.

Key Points About Shares:

- Ownership: Buying shares gives you partial ownership of the company, with rights to vote on company decisions and receive dividends.

- Dividends: Shareholders may receive a portion of the company’s profits, usually paid twice a year.

- Capital Growth: Shares can increase in value, allowing you to profit by selling them at a higher price than you paid.

- Voting Rights: Shareholders can vote on major issues, like electing directors or approving mergers.

- Risk: Shares are generally riskier than bonds, but they offer higher potential returns through capital growth and dividends.

- Limited Liability: Your liability is limited to the amount you’ve invested, meaning you can’t lose more than you paid for the shares.

How Do Shares Make Money?

Shares generate income in two main ways:

- Capital Gains: Selling shares for more than you bought them generates a profit.

- Dividends: Companies may distribute profits to shareholders as dividends, providing a regular income stream.

Different Types of Shares:

- Ordinary Shares: The most common type, offering voting rights and dividends based on the company’s performance.

- Preference Shares: Provide a fixed dividend but typically lack voting rights. They have priority over ordinary shares for dividends and asset distribution in case of liquidation.

Investing in Shares vs. Savings Accounts:

While savings accounts offer lower risk and guaranteed returns, investing in shares can deliver higher returns over the long term. Shares allow for capital growth and income through dividends, making them a powerful tool for building wealth.

Considerations for Shareholders:

- Market Fluctuations: Share prices are influenced by company performance, economic trends, and market conditions, which can result in price volatility.

- Valuation: Shares are often evaluated using the price-to-earnings (P/E) ratio, a common method for comparing shares within and across industries.

For investors seeking a mix of growth and income, shares can offer substantial benefits, especially when combined with a diversified portfolio. Whether pursuing capital growth, regular income, or a combination of both, shares are a key component of a successful investment strategy.

Exchange Traded Funds

Exchange-Traded Funds (ETFs) are a collection of securities such as stocks or bonds that are traded on exchanges like the Australian Securities Exchange (ASX), similar to individual shares. They provide an easy and affordable way to gain broad exposure to a wide range of asset classes and investment strategies.

Key Benefits of ETFs:

- Trading Flexibility: ETFs can be bought and sold throughout the trading day, offering flexibility compared to mutual funds, which only trade once per day.

- Low Fees: ETFs typically have lower fees compared to mutual funds due to their passive management structure.

- Low Entry Cost: You can start investing in ETFs with as little as the price of one share, making them accessible for all investors.

- Tax Efficiency: ETFs are known for being tax-efficient as they realise fewer capital gains compared to actively managed funds.

Types of ETFs:

- Index-based ETFs: Track specific indexes like the S&P/ASX 200, replicating the performance of the index’s underlying assets.

- Actively Managed ETFs: Aim to outperform an index by using active management strategies to achieve specific investment goals.

- Sector and Thematic ETFs: Focus on specific industries or trends like healthcare, technology, or renewable energy.

- Fixed Income and Bond ETFs: Provide exposure to government or corporate bonds, offering a more stable income stream for conservative investors.

- Commodity ETFs: Track commodities like gold, oil, or agricultural products.

Why Invest in ETFs?

- Diversification: With one trade, ETFs offer exposure to a broad portfolio of assets, reducing risk and improving diversification.

- Liquidity: ETFs are traded on the ASX and can be bought or sold easily during the trading day.

- Transparency: Investors can check the underlying assets in an ETF daily, offering full transparency.

- Cost-Effective: ETFs generally have lower management fees compared to actively managed funds.

- SMSF Friendly: ETFs are eligible to be included in Self-Managed Super Funds (SMSFs), making them a popular choice for retirement planning.

Popular ETF Categories:

- Australian Shares: Gain exposure to large-cap Australian companies or specific sectors like financials and resources.

- International Shares: Invest in global markets, including U.S. stocks, European sectors, or emerging markets.

- Property and Real Estate: ETFs that focus on real estate investment trusts (REITs), providing income and diversification in property investments.

- Precious Metals: Invest in commodities like gold or silver for diversification and protection against market volatility.

- Thematic ETFs: Target specific investment trends, such as cybersecurity, artificial intelligence (AI), and sustainability.

Risks to Consider:

- Market Risk: The value of ETFs may fluctuate with market movements, and investors could lose money during downturns.

- Foreign Investment Risk: Investing in international ETFs exposes you to currency and geopolitical risks.

- Liquidity Risk: In some cases, it may be harder to sell an ETF quickly, especially in volatile or illiquid markets.

Conclusion:

ETFs are an attractive investment option due to their simplicity, affordability, and diversification benefits. Whether you’re building a core portfolio or looking to capitalise on specific sectors or trends, ETFs provide flexible and transparent solutions for a wide range of investors.

Managed Funds

Managed funds allow investors to pool their money together, which is then used by a professional fund manager to invest in a variety of assets like shares, bonds, property, or cash. The fund manager makes the buying and selling decisions on behalf of investors, aiming to generate positive returns in line with the fund’s objectives. Managed funds provide an easy way to access a range of investment opportunities and help diversify your portfolio.

How Managed Funds Work:

- Investors buy units in the fund, which represent their proportionate share of the fund’s assets. The value of these units fluctuates based on the market value of the underlying assets.

- The fund manager invests the pooled money in line with the fund’s goals, and returns are distributed as capital growth or dividends.

- Managed funds can be actively or passively managed. Active funds aim to outperform a benchmark through active decision-making, while passive funds simply track a market index.

Types of Managed Funds:

- Managed Investment Schemes: A common structure in Australia that pools investor funds to invest in assets like shares or property.

- Corporate Collective Investment Vehicles (CCIVs): These are a type of investment structure that provides a flexible and tax-efficient way to invest.

Key Benefits of Managed Funds:

- Diversification: Managed funds spread your investment across multiple asset classes, companies, or industries, reducing risk.

- Professional Management: A fund manager makes decisions on your behalf, saving you time and providing expert investment management.

- Access to Various Assets: Managed funds give you access to asset classes that might otherwise be difficult to invest in, such as global markets, corporate bonds, or property.

What to Consider When Choosing a Managed Fund:

- Investment Objectives: Choose a fund that matches your financial goals, whether you’re seeking income, growth, or a balanced mix of both.

- Fees: Managed funds charge fees that can reduce your returns over time. Be sure to understand the fee structure before investing.

- Risk: Managed funds come with varying levels of risk. Consider your risk tolerance when choosing a fund, especially if it uses strategies like leverage or derivatives.

- Taxation: The tax implications of managed funds are different from direct shares, so it’s important to consult a tax advisor.

Investment Strategies:

- Managed funds can be tailored to different investment strategies, such as income funds that invest in high-quality, dividend-paying shares and bonds, or growth funds that focus on long-term capital appreciation by investing in smaller, high-growth companies.

Advantages of Managed Funds:

- Lower Entry Cost: Investing in a managed fund often requires a lower entry point than buying individual shares directly, making it accessible to many investors.

- Regular Income: Managed funds may provide a steady income stream through dividends or interest payments, which can be reinvested to grow your wealth.

- Risk Mitigation: By spreading investments across different asset classes, managed funds can reduce the risk of any one investment performing poorly.

Disadvantages of Managed Funds:

- Fees: Managed funds often charge higher fees compared to other investment options, like ETFs, which can eat into your returns.

- Performance Risk: Actively managed funds do not always outperform their benchmarks, meaning there is no guarantee of higher returns despite the higher fees.

- Liquidity Issues: Managed funds may not offer immediate access to your money, especially in times of market stress.

Investing in Managed Funds:

To invest in a managed fund, you purchase units in the fund. The unit price reflects the market value of the assets held by the fund. As the value of the assets increases, so does the unit price, providing capital growth for investors. Income distributions can also be paid out, depending on the performance of the underlying assets.

Managed funds are a great option for those looking for diversification, professional management, and access to a variety of markets and asset classes without having to manage the investments personally. However, it’s important to weigh the pros and cons, understand the fees, and ensure the fund aligns with your investment goals.

The Bottom Line:

While managed funds offer a hands-off approach to investing, it’s important to carefully select the right fund to match your financial objectives. Speak with Private Capital Management to ensure you’re choosing the best option for your portfolio and risk profile.

Self-Managed Super Funds

A Self-Managed Super Fund (SMSF) is a private superannuation fund in Australia that gives individuals more control over how their retirement savings are invested. Managed by its members, an SMSF provides flexibility in investment choices, such as real estate and shares, which can be tailored to individual financial goals.

How an SMSF Works:

In an SMSF, members act as trustees, taking full responsibility for managing the fund’s investments and ensuring compliance with superannuation and tax laws. This hands-on approach allows members to choose and monitor their investments, but it also requires significant involvement in regulatory compliance and administration.

Key Benefits of SMSFs:

- Greater Control: SMSF members have complete control over their investment choices, including unique assets like property or collectibles that may not be available through public super funds.

- Flexibility: SMSFs allow for tailored investment strategies that align with personal retirement goals. Members can also borrow to invest in property under a Limited Recourse Borrowing Arrangement (LRBA).

- Tax Benefits: Like other super funds, SMSFs benefit from concessional tax rates, with investment returns taxed at a maximum of 15%. Additionally, super payouts after age 60 are tax-free.

- Investment Scale: With up to six members allowed, SMSFs can pool resources, gaining access to investment opportunities and potentially reducing costs.

- Estate Planning: SMSFs offer more control over how death benefits are distributed, allowing for tax-efficient strategies and precise estate planning.

Risks and Responsibilities:

- Time and Expertise: Managing an SMSF requires significant financial, legal, and administrative knowledge. Members are responsible for ensuring compliance with all super and tax laws, which can be time-consuming.

- Costs: Setting up and running an SMSF can be costly, especially for those with lower balances. Ongoing administration, audit, and reporting fees can add up.

- Compliance: Failure to meet legal requirements can result in heavy fines, loss of concessional tax treatment, or even criminal penalties.

- Insurance: SMSFs may not offer the same competitive insurance rates as larger public funds, leading to higher costs for coverage.

Setting Up an SMSF:

To set up an SMSF, members must appoint trustees, create a trust deed, and register the fund with the Australian Taxation Office (ATO). Each SMSF requires a dedicated bank account, and a comprehensive written investment strategy that outlines the fund’s objectives. Private Capital Management can assist with creating compliant, well-structured SMSFs that align with long-term financial goals.

Why Choose Private Capital Management for Your SMSF?

Private Capital Management can provide expert guidance on setting up and managing an SMSF, ensuring compliance with regulations and optimising tax benefits. From crafting investment strategies to handling administrative tasks, Private Capital Management ensures that your SMSF is managed efficiently, allowing you to focus on your financial future.

Is an SMSF Right for You?

While SMSFs offer significant benefits, they are not suitable for everyone. Private Capital Management can help assess whether an SMSF is the right choice based on your financial situation, investment knowledge, and retirement goals.

Industry Super Funds

Industry super funds are not-for-profit superannuation funds in Australia, run to benefit their members rather than external shareholders. Originally developed by trade unions and industry bodies for workers in specific industries, many industry funds are now open to the public, allowing anyone to join.

How Industry Super Funds Work:

Industry funds operate under a mutual, not-for-profit structure, meaning all profits are returned to the members. This structure results in lower fees compared to other types of super funds, as profits are reinvested rather than distributed to shareholders. This setup allows for cost-effective fund management while maintaining strong performance over time.

Benefits of Industry Super Funds:

- Lower Fees: Industry funds typically offer lower management fees than retail funds, making them an attractive option for long-term retirement savings.

- Member-First Focus: Profits are returned to the members, not to external shareholders, maximizing returns for investors.

- Strong Investment Performance: Historically, industry super funds have consistently outperformed retail funds across multiple asset classes, as found in reports from the Productivity Commission. Many industry funds, such as AustralianSuper and Aware Super, are among Australia’s top-performing superannuation funds.

- Specialised Insurance Coverage: Some industry funds offer tailored insurance coverage for workers in specific industries. For instance, Cbus Super provides automatic insurance for construction workers, including those in high-risk roles, which may not be offered by other funds.

Potential Drawbacks:

- Limited Investment Options: While most large industry funds offer a diverse range of investment options, their selection may still be more limited compared to retail funds, which tend to provide more customisable portfolios.

Why Choose Private Capital Management?

Private Capital Management can help clients navigate the complex world of superannuation, ensuring you choose the best industry fund suited to your long-term financial goals. From understanding fees to maximising tax benefits and selecting the right investment strategy, Private Capital Management provides expert guidance to optimise your retirement savings.

Insurance

In Australia, various insurance options such as life insurance, total and permanent disability (TPD) insurance, trauma insurance, and income protection insurance can help safeguard your financial future. Private Capital Management offers personalised advice on these essential policies to ensure you’re adequately protected.

Types of Insurance:

- Life Insurance: Provides a lump sum to your beneficiaries in the event of your death, ensuring financial security for your loved ones.

- Total and Permanent Disability (TPD) Insurance: Pays a lump sum if you become permanently disabled and can no longer work. There are two definitions—own occupation or any occupation—which determine the conditions under which you can claim.

- Trauma Insurance: Also known as critical illness insurance, this provides a lump sum payment if you are diagnosed with a severe condition like cancer, heart attack, or stroke. However, it doesn’t cover all conditions, so checking the policy specifics is crucial.

- Income Protection Insurance: Replaces up to 75% of your income if you’re unable to work due to illness or injury, helping cover living expenses and debt repayments while you recover.

Key Considerations:

- TPD Insurance: You need to be off work for at least three months before making a claim, and policies can vary between “own occupation” or “any occupation” cover. Private Capital Management helps you choose the best option tailored to your situation.

- Income Protection: Policies offer different waiting periods (30, 90, or 720 days) and benefit periods. Private Capital Management assists in selecting the right combination based on your financial obligations and lifestyle needs.

- Trauma Insurance: Can help with medical costs, lifestyle changes, and covering bills during recovery. Private Capital Management ensures you choose the appropriate coverage for your health and financial situation.

- Linked Policies: You can bundle TPD and trauma insurance with life cover, potentially lowering premiums. However, keep in mind that claiming on one policy may reduce the payout on another, which is something Private Capital Management will guide you through to ensure you have the best cover in place.

Benefits of Insurance:

- Financial Security: Provides peace of mind knowing you and your family are financially protected if something unexpected happens.

- Tax Benefits: Some policies, such as income protection insurance, may offer tax-deductible premiums. Private Capital Management can assist in structuring your policies to maximise tax benefits.

- Customised Solutions: With Private Capital Management, you’ll receive tailored advice that ensures you have the right cover for your specific needs and life stage.

Disadvantages to Consider:

- Exclusions: Trauma insurance policies may not cover all conditions, and TPD claims can take longer due to detailed medical assessments.

- Premium Costs: While linked policies can reduce premiums, they may also lower total payouts. Private Capital Management helps weigh these factors to find the best value for your insurance needs.

Why Choose Private Capital Management?

Private Capital Management helps clients navigate the complex world of insurance, ensuring the best policies for protecting their financial future. From understanding premiums and policy structures to maximizing tax benefits and providing expert advice, Private Capital Management ensures your insurance is optimised for your long-term goals.

Investment Property

Investing in an investment property in Australia can be a lucrative way to build wealth and generate passive income. Whether through rental income or capital growth, investment properties offer significant financial benefits but also require careful consideration and planning. Private Capital Management offers expert advice to help you make the right decisions based on your goals and circumstances.

Key Factors to Consider:

- Location: Properties in high-growth areas near public transport, schools, and amenities often attract better rental yields and capital growth.

- Maintenance: Low-maintenance properties can reduce ongoing costs.

- Vacancy Rates: Understanding local vacancy rates helps predict rental demand.

- Broad Appeal: Choose properties that appeal to a wide range of renters to reduce vacancy risks.

- Tax Benefits: Many property-related expenses are tax-deductible, including interest on loans, maintenance costs, and depreciation.

- Capital Gains Tax: Be aware of potential taxes when selling for a profit.

Costs of Investing:

Investing in property involves several costs beyond the purchase price, including stamp duty, legal fees, inspections, and loan setup costs. It’s important to factor in the ongoing costs of owning the property, such as council rates, insurance, property management fees, and maintenance.

Pros of Property Investment:

- Less Volatility: Property tends to be less volatile than other investments like shares.

- Income Generation: Rental income can provide a steady cash flow.

- Long-term Capital Growth: Over time, property values tend to increase, providing capital gains.

- Tax Deductions: Many expenses can be deducted from your taxable income, reducing your overall tax liability.

- Tangible Asset: Property is a physical asset that you can see and manage.

Cons of Property Investment:

- High Entry Costs: Initial costs, including deposits and fees, can be significant.

- Interest Rate Sensitivity: Rising interest rates can increase mortgage payments and reduce disposable income.

- Vacancy Risks: There may be periods without tenants, leaving you to cover the costs.

- Inflexibility: Property is not a liquid asset; selling it to access cash can take time and incur costs.

- Property Price Depreciation: If property values fall, you may owe more than the property is worth.

Long-Term Returns:

Investment properties have the potential to deliver long-term financial gains, with rental income supporting short-term cash flow and capital appreciation offering profits upon sale. Private Capital Management helps clients analyse market trends, property locations, and financing options to ensure the best returns on investment.

Financing and Tax Strategy:

Using strategies such as negative gearing and leveraging equity from existing properties, Private Capital Management can advise on tax-efficient ways to structure your investments and manage your cash flow effectively.

For personalised guidance on building a property portfolio, Private Capital Management helps investors navigate all aspects of property investment, from selection and purchase to management and eventual sale.

Wrap Platforms

In Australia, a wrap platform (also known as a wrap account or master trust) provides a comprehensive solution for investors to consolidate and manage their portfolios across a range of investment options, including managed funds, listed securities, cash, and property. With Private Capital Management, clients gain access to this powerful tool for seamless investment management and enjoy cost-effective options, often at rates lower than industry super funds.

Generally, we use Wrap’s for superannuation where total costs can be well-below industry super funds. Non-super investments are generally direct and off-platform.

Key Features of a Wrap Platform with Private Capital Management:

- Wide Range of Investment Options: Clients can diversify their portfolios with access to a variety of investments, such as shares, managed funds, international equities, pensions, and even property, all managed in one platform.

- Consolidated Reporting: Enjoy simplified reporting, where tax summaries, performance reports, and transactions are consolidated into one place, offering full transparency across the entire portfolio.

- Cost-Effective Solutions: Private Capital Management provides highly competitive fee structures, often less than what industry super funds charge. This makes wrap platforms a more affordable option, especially for investors seeking professional management without the high costs typically associated with industry funds.

- Professional Management: With Private Capital Management, clients can benefit from expert financial advice tailored to their personal goals. Whether you choose to manage your investments or have a professional advisor handle them, your portfolio is built and maintained with your financial success in mind.

Benefits of a Wrap Platform:

- Lower Fees Than Industry Super Funds: Thanks to the access to wholesale funds and the efficient management provided by Private Capital Management, clients benefit from lower fees compared to many industry super fund options.

- Tax Efficiency: Wrap platforms offer consolidated tax reporting, simplifying tax filings and ensuring tax efficiency.

- Diverse Investment Choices: Access to a wider range of investment opportunities, including those that might have high entry thresholds, allowing for better portfolio diversification.

- Simplified Management: By consolidating multiple assets into one platform, wrap platforms streamline investment monitoring and reporting.

Considerations:

- Wrap Fees: While fees are generally lower than many other investment structures, wrap platforms do charge a single percentage fee based on assets under management. Private Capital Management offers some of the most cost-effective options in the market, which is ideal for clients who wish to avoid excessive fee structures.

- Complexity: Wrap platforms have a simple fee structure, but understanding the underlying costs of certain funds can sometimes be complex. We help clients navigate this easily with full transparency and support.

Wrap Platforms vs SMSFs:

- For those with smaller account balances, wrap platforms tend to be more cost-effective than SMSFs, which are generally more suitable for larger portfolios due to their high fixed costs.

- Private Capital Management ensures wrap platform clients gain access to high-quality, low-cost investment options, making it a more appealing choice compared to SMSFs for those looking to keep their fees low while benefiting from professional management.

High Interest Savings Accounts

A high-interest savings account (HISA) is a type of bank account designed to help individuals grow their savings faster by offering higher-than-usual interest rates on deposited funds. These accounts function similarly to standard savings accounts but with the added benefit of paying more interest, usually on a monthly basis, which is calculated based on the amount you have saved.

To benefit from the highest available rates, banks may impose certain conditions such as maintaining a minimum monthly deposit, making no withdrawals, or linking the savings account to an everyday transaction account. These conditions help encourage disciplined saving habits.

Features and Benefits of High-Interest Savings Accounts:

- Base Interest Rate: The minimum interest rate paid on your balance, even if you don’t meet certain conditions.

- Bonus Interest Rate: A higher rate that is applied when specific conditions (e.g., monthly deposits, no withdrawals) are met.

- Introductory Interest Rate: Some accounts offer an elevated interest rate for an initial period (often 3-6 months) to attract new customers.

- Tiered Interest Rates: Some accounts may offer different interest rates depending on your balance. For example, you may earn a higher interest rate on the first $10,000 and a lower rate on any amounts above that.

How to Choose the Best High-Interest Savings Account:

- Check Bonus Interest Conditions: To unlock the highest rates, you may need to meet monthly criteria such as making deposits or avoiding withdrawals.

- Ongoing vs Introductory Rates: Look for accounts with competitive ongoing rates rather than those offering only short-term introductory rates unless you’re willing to switch regularly.

- Account Fees: Most high-interest savings accounts don’t charge monthly fees, but be mindful of hidden fees like those for paper statements or branch withdrawals.

- Maximum Balance for Interest: Be aware of any limits on the balance that earns the top rate of interest, as some accounts cap this at a certain amount.

- Authorised Deposit-Taking Institutions (ADIs): Ensure your savings account is with an ADI to benefit from the government’s Financial Claims Scheme, which protects deposits up to $250,000.

Why Use a High-Interest Savings Account?

- Grow Your Savings Faster: With higher interest rates, your money grows more quickly compared to regular savings accounts.

- Low Risk: Savings accounts are generally low-risk, especially when held with an ADI, offering peace of mind.

- Accessibility: While these accounts are primarily for savings, funds are still accessible if needed, although certain conditions may apply to avoid penalty fees or losing bonus interest.

If you’re looking to maximise the returns on your cash savings, a high-interest savings account can be a useful tool. Private Capital Management can help you navigate the various options and select the best account to meet your financial goals.

Share Brokerage Accounts

When it comes to share brokerage accounts in Australia, a well-structured approach can significantly enhance your investment strategy. Through a brokerage account, you can buy, sell, and hold financial securities like shares, ETFs, REITs, bonds, and other assets. However, understanding the nuances of these accounts is critical for long-term success, which is where Private Capital Management can assist in tailoring a plan to meet your specific financial goals.

How Share Brokerage Accounts Work

Private Capital Management begins by opening a brokerage account for you with a trusted broker. Once the account is active, we will help manage your trades and investments according to your financial objectives. These accounts are versatile, allowing access to various asset classes and trading instruments, making them ideal for investors looking to diversify their portfolio.

Managing Fees:

One of the most significant aspects of any brokerage account is understanding and managing the fees. Typically, you’ll incur a transaction fee ranging from $15 to $20 for each trade. Additional costs such as foreign exchange fees, inactivity fees, or subscription fees might apply. Private Capital Management works with you to minimize these costs through careful planning, potentially using lower-cost online brokerage platforms for your trades. We will review all costs in detail to ensure they align with your budget and investment strategy.

Choosing the Right Investment Products:

At Private Capital Management, we focus on aligning your investments with your financial goals. Whether you’re looking to invest in shares, ETFs, or REITs, we provide expert guidance to help you choose the right securities. For those seeking diversified portfolios, we explore various asset classes, including:

- Shares: Owning individual company stocks.

- ETFs: Investing in funds that track market indexes.

- Bonds and LICs: Fixed-income securities and listed investment companies.

- REITs: Real estate investment trusts for exposure to property.

By customising the right mix of investments, we ensure your portfolio is designed to deliver long-term growth and risk management, based on your financial situation and future objectives.

Tax Reporting and Portfolio Monitoring:

One of the advantages of working with Private Capital Management is our ability to assist you in maintaining accurate records for tax reporting. Any capital gains or losses you incur from share trading must be reported in your tax returns, and we streamline this process by consolidating your transactions and ensuring accurate reporting. Additionally, we provide continuous portfolio monitoring, helping you stay on track with your financial goals and quickly identifying opportunities or risks.

Benefits of Working with Private Capital Management:

As financial planners, Private Capital Management ensures that your brokerage account is optimised for both growth and cost-efficiency. Key benefits include:

- Cost-effective trading: By leveraging online platforms with lower fees, we help reduce the cost of trading while maintaining access to robust portfolio management tools.

- Diversification: Through the right mix of investments across various markets, including shares, ETFs, and bonds, we help spread risk and increase potential returns.

- Professional management: Our expertise in monitoring market movements and adjusting your portfolio ensures that you take advantage of opportunities while mitigating risks.

- Tax efficiency: We assist in keeping your tax liabilities in check, ensuring you get the most out of your investments.

Tailored for Your Needs:

Ultimately, choosing the right brokerage platform and investment strategy depends on your specific goals, risk tolerance, and investment timeline. Private Capital Management works closely with you to identify the best options, from low-cost online brokerages to diversified investment portfolios. Whether you’re a seasoned investor or just getting started, we provide ongoing support, helping you navigate the complexities of the investment world while focusing on your long-term financial success.

ESTATE PLANNING

Estate planning is a critical part of financial and legal management that ensures the orderly distribution of assets after death, while protecting loved ones from unnecessary disputes and emotional stress. A well-structured estate plan provides clarity on asset distribution, minimises tax liabilities, and ensures that the deceased’s wishes are honoured.

Key Elements of Estate Planning:

- Will: Outlines how estate assets are distributed and appoints an executor to manage the estate according to the specified wishes.

- Power of Attorney: Grants authority to a trusted person to manage financial and legal affairs, including an Enduring Power of Attorney, which continues in effect if the individual becomes incapacitated.

- Enduring Guardianship: Appoints a guardian to make decisions about health and lifestyle when the individual is no longer able to make them.

- Advance Care Directive: Also known as a living will, this document specifies medical and end-of-life care preferences if the individual cannot communicate those decisions.

- Trusts: Allows assets to be administered by a trustee for designated beneficiaries, offering tax benefits and asset protection.

- Superannuation: A significant part of Australian estate planning, ensuring super funds are distributed to nominated beneficiaries in a tax-efficient manner.

- Guardianship of Minor Children: Names a guardian in the will to care for dependent children if both parents pass away.

Legal Considerations for Estate Planning:

- Validity: All documents must comply with the relevant legal requirements in Australia, such as the Succession Act or Wills Act, to ensure they are valid.

- Tax Implications: Consider potential tax consequences, including capital gains tax, stamp duty, and income tax, when transferring assets to beneficiaries.

- Family Law Considerations: Divorce or separation can impact estate plans, making it essential to review and update documents accordingly.

- Capacity: The individual must be of sound mind when creating a will, ensuring decisions are valid and reducing the risk of future disputes.

Estate planning is essential for protecting wealth, reducing taxes, and ensuring your wishes are fulfilled. With proper planning, families can navigate the complexities of wealth transfer smoothly, preserving assets for future generations while minimising legal and financial challenges.

Investment Property Deprecation Schedules

Property depreciation allows investors to claim tax deductions for the decline in value of their investment property’s assets over time. Understanding how to use depreciation schedules effectively can significantly reduce your taxable income, maximising your return on investment. Private Capital Management can help investors take advantage of these deductions by ensuring you have an accurate and up-to-date depreciation schedule.

What is Property Depreciation?

Depreciation refers to the wear and tear on a property’s structure and fixtures. In Australia, the Australian Taxation Office (ATO) allows property investors to claim depreciation on both the building itself (capital works deductions) and its assets (plant and equipment). Common depreciable items include carpets, appliances, air-conditioning units, and more.

Key Components of a Depreciation Schedule:

- Capital Works (Division 43): This relates to the building’s structure and any improvements, such as renovations. Typically, properties built after 1987 are eligible for these deductions.

- Plant and Equipment (Division 40): These are removable assets like carpets, blinds, and air conditioners. Depreciation rates vary based on the asset’s expected lifespan.

Benefits of a Depreciation Schedule:

- Increased Tax Deductions: A well-prepared depreciation schedule can reduce your taxable income, increasing your return on investment.

- Long-Term Tax Savings: Depreciation deductions can be claimed annually, often providing substantial tax relief over many years.

- Professional Assessments: Property depreciation schedules are best prepared by quantity surveyors, who are experts in assessing depreciation and ensuring compliance with ATO guidelines.

Importance of Professional Advice:

Private Capital Management works with leading quantity surveyors to ensure that your depreciation schedule is comprehensive and maximises your tax savings. By collaborating with a team of financial experts, you can ensure your investment property strategy is optimised for long-term success.

What to Expect in a Depreciation Schedule:

- Detailed Breakdown: The schedule outlines all depreciable items, providing an estimate of the deduction values over the life of the asset.

- Accurate Assessments: Quantity surveyors physically inspect the property to assess its assets and estimate their lifespan.

- Compliance with ATO Regulations: It’s crucial that depreciation schedules are compliant with tax laws to avoid issues during tax assessments.

Why You Need Private Capital Management:

- Tailored Tax (Financial) Advice: Private Capital Management helps property investors understand how depreciation fits into their overall tax strategy, ensuring that all eligible deductions are claimed.

- Comprehensive Financial Planning: Beyond just depreciation, we guide clients through the entire property investment journey, from financing to exit strategy.

- Long-Term Financial Goals: We assist investors in building wealth and achieving financial independence through property, offering expert advice that aligns with your personal financial goals.

Superannuation

Superannuation, or super, is a fundamental part of retirement planning in Australia, designed to help individuals save for their future. Super is an investment that grows over time, and both employers and individuals contribute to it. Managed by super funds, these contributions are invested in a range of assets including shares, bonds, property, and cash, allowing your money to grow over time. Superannuation is essential because it helps ensure financial stability after retirement.

How Private Capital Management Can Assist with Superannuation:

Private Capital Management plays a vital role in optimising your superannuation by offering personalised strategies to maximise growth, tax efficiency and long-term benefits. We help clients choose the right super fund that aligns with their financial goals, while also navigating the complexities of contributions, withdrawals, and investment options.

Key Features of Superannuation:

- Employer Contributions: Employers are required to contribute a portion of your salary (known as the Superannuation Guarantee) into your super fund. You can also make voluntary contributions to boost your retirement savings.

- Investment Choices: Super funds offer a variety of investment options, ranging from low-risk assets like cash and bonds to higher-risk assets like shares and property. Private Capital Management can assist in selecting the most suitable investment strategy based on your risk tolerance and long-term financial goals.

- Tax Advantages: Superannuation is a tax-effective way to save for retirement. Contributions made from your pre-tax salary are taxed at a concessional rate of 15%, which is generally lower than your marginal tax rate. Private Capital Management can also help optimise tax strategies such as salary sacrificing and tax offsets, ensuring you make the most of the tax benefits available.

- Accessing Superannuation: You can generally access your superannuation once you reach preservation age (usually 60) and retire. However, under certain circumstances, such as severe financial hardship or specific medical conditions, early access may be allowed. Private Capital Management provides guidance on the best time and method to access super, ensuring it aligns with your retirement plans.

- Super Fund Selection: Choosing the right super fund is crucial. Private Capital Management helps clients compare super funds based on performance, fees, and investment options, ensuring you are in a fund that meets your needs. Options include industry funds, retail funds, and self-managed super funds (SMSFs), depending on your level of involvement and control.

Benefits of Superannuation:

- Tax Efficiency: Contributions and earnings within super are taxed at a lower rate, making it a tax-efficient way to save.

- Long-Term Growth: Super funds invest in a range of assets, helping your savings grow over time.

- Tailored Strategies: With Private Capital Management, you can develop a strategy that aligns with your financial goals, maximising returns while minimizing risks.

Disadvantages:

- Limited Access: Funds are generally locked away until you retire, making it less flexible for short-term needs.

- Market Volatility: Depending on your investment strategy, your super can be subject to market risks.

In conclusion, superannuation is a powerful tool for retirement planning, offering tax benefits, long-term growth, and a structured way to save for your future. Private Capital Management provides the expertise to help navigate the complexities of super, ensuring you are well-prepared for retirement while maximising the value of your contributions.

Concessional and Non-Concessional Contributions

Superannuation in Australia allows for two types of contributions: concessional (before-tax) and non-concessional (after-tax). Each type serves a unique purpose, offering distinct tax advantages and opportunities to boost retirement savings. Understanding these contributions, along with the caps and eligibility criteria set by the Australian Taxation Office (ATO), is essential for maximizing superannuation benefits and avoiding additional tax penalties.

What Are Concessional Contributions?

Concessional contributions are made from pre-tax income and include employer superannuation guarantee payments, salary sacrifice contributions, and personal contributions that qualify for a tax deduction. These contributions are taxed at 15% within the super fund, making them a tax-effective way to grow retirement savings, especially for individuals in higher tax brackets. However, high-income earners with combined incomes exceeding $250,000 may incur Division 293 tax, which raises the tax on concessional contributions to 30%.

The annual concessional contribution cap is $30,000. However, individuals with a super balance below $500,000 can take advantage of the carry-forward rule, allowing them to apply any unused contribution cap over a rolling five-year period. This strategy is particularly beneficial for those with irregular income, such as self-employed professionals or business owners.

What Are Non-Concessional Contributions?

Non-concessional contributions come from after-tax income and help individuals boost their super without additional taxation when funds are accessed in retirement. The standard non-concessional cap is $110,000 per financial year, but with the bring-forward rule, individuals can contribute up to $330,000 over a three-year period. This option can be especially advantageous for those receiving windfalls, inheritances, or business sale proceeds.

Certain contributions, such as downsizer contributions from the sale of a home or re-contributions of early COVID-19 withdrawals, do not count toward the non-concessional cap. These rules offer flexibility and encourage retirement savings, particularly for those transitioning into retirement.

Key Differences Between Concessional and Non-Concessional Contributions:

While both contribution types increase retirement savings, concessional contributions lower taxable income immediately and are subject to 15% tax within the fund. Non-concessional contributions, on the other hand, offer tax-free investment growth once individuals start drawing an income stream at age 60.

Those exceeding contribution caps may face additional tax penalties. For concessional contributions, excess amounts may be refunded, but any remaining excess is taxed at the individual’s marginal tax rate, plus a penalty. Non-concessional contributions exceeding the cap are taxed at 47%, underscoring the importance of careful planning.

How Private Capital Management Can Help

Effective management of super contributions is essential for long-term financial security. Private Capital Management can help clients develop customized strategies, such as optimizing salary sacrifice arrangements, leveraging the carry-forward rule, and managing contribution caps. By integrating superannuation strategies into a broader financial plan, clients can maximise retirement savings while ensuring compliance with tax regulations.

Our team can guide you through super fund selection, contribution limits, and effective tax planning, offering the tools and insights needed to build wealth sustainably. Contact us to explore how these strategies can align with your financial goals and support a secure retirement.

What is a Statement of Advice

A Statement of Advice (SOA) is a formal, personalised financial plan provided by licensed professionals to guide clients on their financial journey. In Australia, financial planners holding an Australian Financial Services License (AFSL) are required to issue an SOA when delivering personal financial advice. This document provides critical insights and recommendations tailored to individual circumstances, helping clients make informed financial decisions.

Your formal strategy paper will be presented as an SOA at Private Capital Management

Key Components of an SOA:

- Personalised Financial Overview

An SOA reviews the client’s cash flow, superannuation, debt, investments, and insurance needs, offering customised strategies based on their short- and long-term financial objectives.

- Transparency and Compliance

It includes details about the adviser’s licensing, fees, commissions, and potential conflicts of interest, ensuring transparency. Additionally, it complies with ASIC regulations to safeguard client interests.

- Strategic Advice

Recommendations cover investment strategies, retirement planning, tax strategies, estate planning, and debt reduction to align with the client’s financial goals.

- Visual Comparisons and Forecasts

SOAs often use charts to compare the client’s current strategy against recommended changes. Forecasts include projections of income, expenses, and cash flow over several years.

- Alternative Options

If alternative strategies were considered, the SOA explains why those were not selected, helping clients understand the rationale behind the final recommendations.

How SOAs Support Financial Goals:

Engaging with Private Capital Management through an SOA offers peace of mind. It provides clear, actionable strategies and ongoing support to help clients achieve their financial freedom and success. By working with a licensed adviser, clients avoid pitfalls and can confidently move forward toward their financial goals.

Organise a consultation today to learn how Private Capital Management can develop an SOA tailored to your unique financial situation and objectives.

Passive and Active Management

Passive investing aims to replicate the returns of a market segment by tracking a benchmark index like the S&P/ASX 200. This strategy involves investing in index funds or Exchange-Traded Funds (ETFs) that mirror the performance of a specific market index. Because passive funds require minimal management, they typically offer lower fees and greater diversification, which is appealing to cost-conscious investors.

In contrast, active investing seeks to outperform the market by selecting individual stocks or assets that are expected to perform better. However, active management can be costly due to the need for investment managers and analysts, and it doesn’t always guarantee higher returns. Many active funds underperform their benchmarks after accounting for fees, especially over long time horizons.

Benefits of passive investing:

Lower fees: Passive funds have fewer overhead costs, making them more affordable for investors.

Market returns: Passive investors can expect returns that closely match their chosen benchmark.

Diversification: Investing in index funds or ETFs provides broad exposure to various companies, industries, and sectors, reducing risk.

Active investing may still be appropriate in certain cases, especially in niche markets like small-cap funds, where fewer analysts are covering the stocks. This can give fund managers an edge in identifying undervalued opportunities. However, it’s important to choose low-cost active funds for better success in certain market segments.

Considerations for passive investors

While passive funds are generally considered less risky, they can still face market fluctuations. For example, an index fund tracking the S&P 500 may concentrate heavily in a few large companies, introducing stock-specific risk.

Ultimately, the choice between passive and active investing depends on financial goals, risk tolerance, and investment horizon. For many of our clients, an entirely passive portfolio can be a solid, cost-effective strategy, but a combination of both approaches may also work depending on individual preferences and market conditions.

By embracing passive investing, investors can follow the advice of legends like Warren Buffett, who advocates for this approach due to its simplicity, cost efficiency, and long-term reliability over decades of investing success.

The Value-Add of Financial Advice

Vanguard’s Adviser’s Alpha is a framework designed to demonstrate how Private Capital Management can provide value beyond simply managing investments. The strategy focuses on delivering up to 3% additional net returns for clients by using a combination of investment management best practices and behavioural coaching, helping clients make smarter financial decisions that align with long-term goals.

We use this structure as a core philosophy with how we partner with our clients.

How Private Capital Management Adds Value Using Vanguard’s Advisor’s Alpha Strategy

- Asset Allocation: One of the core principles of the Advisor’s Alpha framework is strategic asset allocation. Private Capital Management helps clients by building diversified portfolios tailored to their risk tolerance, investment goals, and time horizons. This custom approach can reduce volatility and improve the probability of achieving financial objectives.

- Behavioural Coaching: One of the most significant ways Private Capital Management can add value is through behavioural coaching. Market volatility can often lead to impulsive, emotion-driven decisions, such as selling off assets during downturns. Advisors at Private Capital Management help clients stay disciplined by sticking to a long-term strategy and avoiding the costly pitfalls of emotional decision-making.

- Cost-Effective Investing: Following the Vanguard Advisor’s Alpha approach, Private Capital Management emphasises cost-effective investment solutions like low-cost ETFs and index funds. Keeping fees and expenses low can significantly boost long-term returns, making this a crucial factor in achieving financial success.

- Tax Efficiency: Tax planning is another essential part of Advisor’s Alpha. Private Capital Management helps clients optimize their portfolios for tax efficiency through strategies such as tax-loss harvesting, placing assets in tax-advantaged accounts, and choosing investments that generate fewer taxable events, ensuring more wealth is retained.

- Rebalancing: Maintaining the appropriate asset allocation over time requires regular rebalancing. Private Capital Management helps clients by systematically adjusting portfolios to match the client’s desired risk level, ensuring that market shifts do not derail long-term investment goals.

- Spending Strategies for Retirement: Vanguard’s framework is a framework designed to demonstrate how firms like Private Capital Management creates customized spending plans that maximise income while minimizing tax liabilities, ensuring clients can maintain their desired lifestyle throughout retirement.

Disadvantages and Limitations:

While the Advisor’s Alpha framework presents many opportunities for added value, it does come with some considerations:

- Dependence on Market Conditions: The potential for additional returns is often tied to market performance, and Private Capital Management’s ability to manage client behaviour during downturns is critical.

- Costs for Professional Advice: While the benefits of working with Private Capital Management can outweigh the costs, it is important for clients to understand the fees involved and ensure they are receiving value for money.

- Long-Term Commitment: Advisor’s Alpha is designed to benefit clients over the long term, which means patience and adherence to the strategy are essential for success.

Conclusion:

Vanguard’s Adviser’s Alpha approach underscores the importance of working with Private Capital Management to drive long-term success. By focusing on cost-effective investing, tax efficiency, strategic asset allocation, and behavioural coaching, Private Capital Management can our help clients achieve their financial goals while maximizing their investment returns. For those seeking to optimise their financial planning strategy, working with Private Capital Management following the principles of Advisor’s Alpha can be a powerful way to achieve lasting financial success.

Education Bonds

An Education Bond in Australia is a unique investment vehicle designed specifically to help individuals save for future educational expenses. These tax-advantaged products allow investors to contribute funds into a professionally managed investment bond, with the potential for long-term growth. Education bonds are particularly appealing because they offer superior after-tax returns, thanks to their structure as a “scholarship plan” under the Australian Income Tax Assessment Act 1997.

Education Bonds offer an efficient and practical way for individuals and families to save for education, with the added benefit of tax efficiency and long-term growth potential. For those planning ahead for school fees, university tuition, or other educational expenses, these bonds provide an excellent way to accumulate savings over time while minimizing tax liabilities.

By contributing to an Education Bond, investors benefit from professional management, diversified investment options, and the security of knowing that the funds can be used to support a wide range of educational goals. With customisability and a flexible investment strategy, Education Bonds remain a powerful tool for those seeking to invest in the future of their children or loved ones.

How Education Bonds Work:

By contributing to an Education Bond, you are investing in a diversified portfolio of assets, including cash, fixed interest, equities, and property. Many Education Bonds use multi-asset strategies to cater to different risk profiles, giving investors the flexibility to match their financial goals.

Additionally, some providers offer customisation options, allowing investors to choose between sector-specific funds or active and passive management strategies. All earnings generated within the bond are reinvested, helping to grow the investment over time, which makes them an attractive solution for long-term educational savings.

Key Benefits of Education Bonds:

- Tax Advantages: One of the primary advantages of Education Bonds is their tax efficiency. They offer superior after-tax returns compared to traditional managed funds, as earnings are taxed within the bond at the lower corporate tax rate and can be withdrawn tax-free under certain conditions.

- Flexibility: Education Bonds offer investment flexibility, allowing individuals to invest in a range of asset classes, and even customise portfolios with active or passive strategies. This helps tailor the bond to specific financial goals and risk preferences.

- No Impact on Social Security: Education Bonds typically do not impact eligibility for means-tested government benefits, making them a useful tool for families planning for education without affecting their social security entitlements.

- Ease of Access: Investors can use the funds for a variety of educational expenses, such as school fees, university tuition, or even vocational training, offering versatile financial support for education.

- Multi-Asset Exposure: By investing in a broad range of asset classes, Education Bonds provide diversification that can reduce overall portfolio risk while aiming for long-term capital growth.

- No Annual Tax Reporting: Investors do not need to report annual earnings from the bond in their personal tax return while the funds remain invested.

Disadvantages of Education Bonds:

Limited Access to Funds: While Education Bonds offer substantial long-term benefits, accessing the funds before a set period may result in reduced tax advantages or penalties, making them less liquid than other investment products.

Management Fees: Depending on the provider and customisation options, Education Bonds may involve management fees that can reduce the overall return on investment.

Risk of Market Fluctuations: As with all investment products, Education Bonds are subject to market risk, particularly for bonds that are exposed to equities or other volatile assets. The value of the investment can fluctuate with market conditions, and there is no guarantee of positive returns.

Specific Use for Educational Purposes: The funds in an Education Bond are designed for educational expenses. While they offer great benefits for this purpose, they are not as flexible as other investment vehicles for non-education-related goals.

Separately Managed Accounts

A Separately Managed Account (SMA) is a customised, professionally managed investment portfolio where investors retain beneficial ownership of the underlying assets. SMAs offer transparency, tax advantages, and cost-efficiency, making them a compelling alternative to traditional managed funds. With lower management, custody, and execution costs compared to retail broking fees, SMAs provide a more efficient investment solution.

SMAs are highly flexible, allowing for personalised asset allocation, including shares, ETFs, and managed funds. Investors benefit from full transparency, as they can track individual holdings in real-time using advanced technology. The direct ownership structure allows for significant tax benefits, such as avoiding embedded capital gains tax liabilities.

SMAs also feature dynamic asset allocation, enabling managers to swiftly adjust portfolios in response to market changes and opportunities. Professional investment managers handle day-to-day decisions, ensuring timely execution and efficient portfolio management without administrative delays.

This combination of customisation, professional management, and complete portfolio visibility offers distinct advantages that are often unavailable with self-managed portfolios or traditional multi-asset options. SMAs are offered through investment platforms, superannuation, and pension funds, making them ideal for clients with varied financial needs and goals.

Benefits of SMAs:

- Personalised Portfolio: Tailored asset allocation and security selection based on individual financial goals.

- Transparency: Full visibility into the underlying holdings, offering greater control over the portfolio.

- Tax Efficiency: Potential for tax benefits by avoiding embedded capital gains tax liabilities, and allowing tax-loss harvesting.

- Professional Management: Access to expert managers who make day-to-day investment decisions.